UNI Europa urges EU to impose ‘Amazon Tax’ in response to US trade war

14.04.25

Amazon continues to benefit from a double unfair economic advantage in the EU: disproportionately low tax rates and lucrative public contracts funded by European taxpayers.

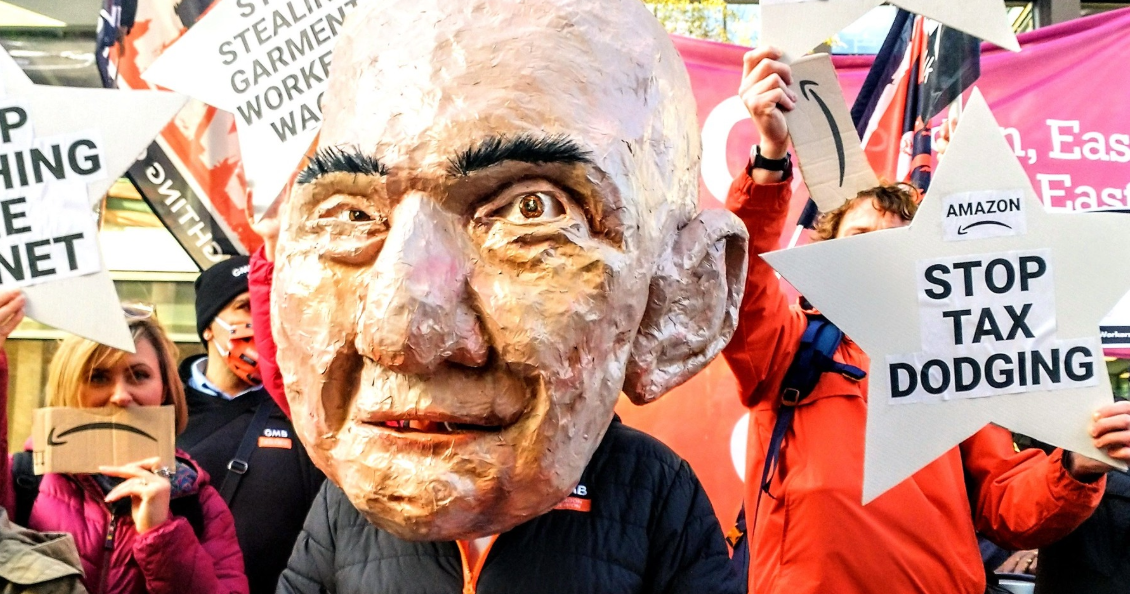

UNI Europa, the European trade union federation representing seven million service sector workers, has called on the European Commission to introduce a comprehensive digital services tax – dubbed ‘Amazon Tax’ – as a countermeasure to escalating trade tensions with the United States.

In a letter to European Commissioners Stéphane Séjourné, Valdis Dombrovskis and Henna Virkkunen, first reported by the Financial Times, the union argued that major US digital companies, particularly Amazon, continue to benefit from unfair economic advantages in the EU, including disproportionately low tax rates and lucrative public contracts funded by European taxpayers.

“Across Europe, major US digital companies pay an average tax rate of approximately 9.5 per cent, while its European competitors are subjected to tax rates two and half times higher,” UNI Europa said, urging the Commission to target digital giants with a tax in response to US tariffs.

Amazon, according to the letter, has paid no corporate tax at its Luxembourg headquarters between 2018 and 2022, despite raking in over €50 billion in revenue in 2022 alone. UNI Europa also cited research showing Amazon Web Services secured more than €1.3 billion in public contracts between 2019 and 2021, and nearly €30 million in direct deals with various EU bodies from 2020 to 2022.

“Amazon is the most egregious example of a double injustice – benefiting from both tax avoidance and public money,” said Oliver Roethig, Regional Secretary of UNI Europa. “European competitors that pay their taxes, treat their workers decently and engage with trade unions are at a disadvantage. An ‘Amazon Tax’ is therefore not just fair – it’s necessary to defend Europe’s economic sovereignty and social model.”

Roethig emphasised that such a tax could level the playing field for European companies that follow the rules and uphold collective bargaining and social dialogue. A study by the Center for European Policy Studies (CEPS) cited by the union suggests that a five percent tax on digital services could generate an additional €37.5 billion annually for the EU.

UNI Europa has requested a written response and a meeting with the Commission in the coming weeks to discuss the proposal in more detail.

Since last year, Amazon has come under fire in Brussels over its refusal to engage in hearings at the European Parliament over working conditions at its warehouses, prompting the withdrawal of its lobbyists’ access badges until a hearing and a visit have taken place.