KB Financial Group Union, participating in the Employee Stock Ownership Plan, mobilizes to improve corporate governance

16.02.23

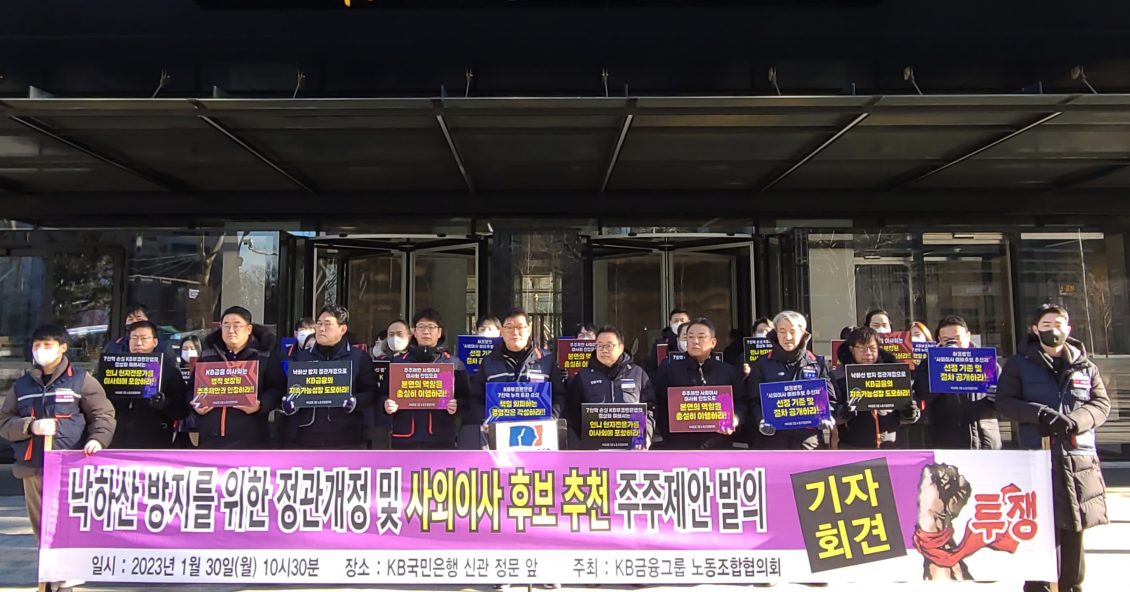

In an effort to strengthen corporate governance at KB Bank and turn around losses from unprofitable foreign investments, the KB Bank Union, a member of UNI affiliate the Korea Finance Industry Union (KFIU), will exercise its shareholder rights at Korea’s largest financial group’s annual meeting to be held on 24 March.

With a recently filed shareholder proposal, the union is urging the bank’s board of directors to appoint an experienced banker as the independent external director. The union is also seeking to revise the group’s articles of incorporation to limit senior government or public administration personnel from parachuting into plum senior executive roles in the financial group immediately upon their ‘retirements’ from office. The union wants the company to apply “Public Officials Ethics Act” in Korea, and its he proposal would require a gap of at least three years to have lapsed before they could be considered for the appointment at the director level within the group.

The KB Financial Group’s union, on behalf of the employee stock ownership programme (ESOP) members representing 20,000 employees and managers, explained it is gravely concerned over the continuing losses incurred by the group’s overseas investment.

In particular, the group’s investment of 2 trillion won in the Indonesia Bukopin Bank has accumulated a loss of 700 billion won to date, with no sign of profitability in sight. It is, for this reason, they recommend the appointment of Mr. Lim Kyung-Jong as their preferred director candidate. He had worked for the Export-Import Bank of Korea for 33 years, including over six years as the CEO of PT KOEXIM Mandiri Finance in Indonesia.

Ryu Je-gang, Chairman of KB Bank Union said, “We are seeking the public’s understanding and support that we are making our proposals as rightful shareholders. This is our sixth attempt ever since the rules were amended in 2017 to allow shareholders to propose external candidates. However, we have yet to see the board of directors accept and appoint competent personnel proposed by shareholders. But we will not give up as we want to contribute to correcting the weak point of KB Financial Group’s overseas business sector and to make the company work for shareholders and financial consumers.”

Bro Park Hong-Bae, KFIU President adds, “We will keep the neutrality and independence of the outside director if the management accepts our proposal this time. There are no concerns about whether the ESOP shareholder’s right will influence negatively the share prices or value evaluation in the capital market.”

UNI Asia & Pacific